Not all of these things are mandatory changes, but may soon become the industry standard that allows customers to expect nothing less. From an influx of digital payments to new fraud measures, there have been a lot of new business trends to welcome. Within the last few years, we have seen a huge shift in how customers are paying and the regulations surrounding those transactions. Because these things often change slowly, you will have plenty of time to implement the new standards into your business.įrom minimum wage changes and tax rate adjustments to health insurance mandates or new building regulations, it is likely that a new law (or change to a regulation) may have impacted something that you need to take into account. This is one of the easier and less ambiguous things you can do to give an outline for annual small business planning. Are there any that may impact your business? The start of the year is usually when new laws, rules, and regulations that were passed in the year prior get rolled out. Financial Planning Tip #1: Refresh Upon Changes Within Your Industry This should help set a guide to get you through the next quarter, the next year, or even the next decade. Luckily, these 5 tips will help you get the ball rolling for creating a steel-clad small business financial planning outline.

Financial Planning Tip #4: Set Attainable Goals and Strategies.

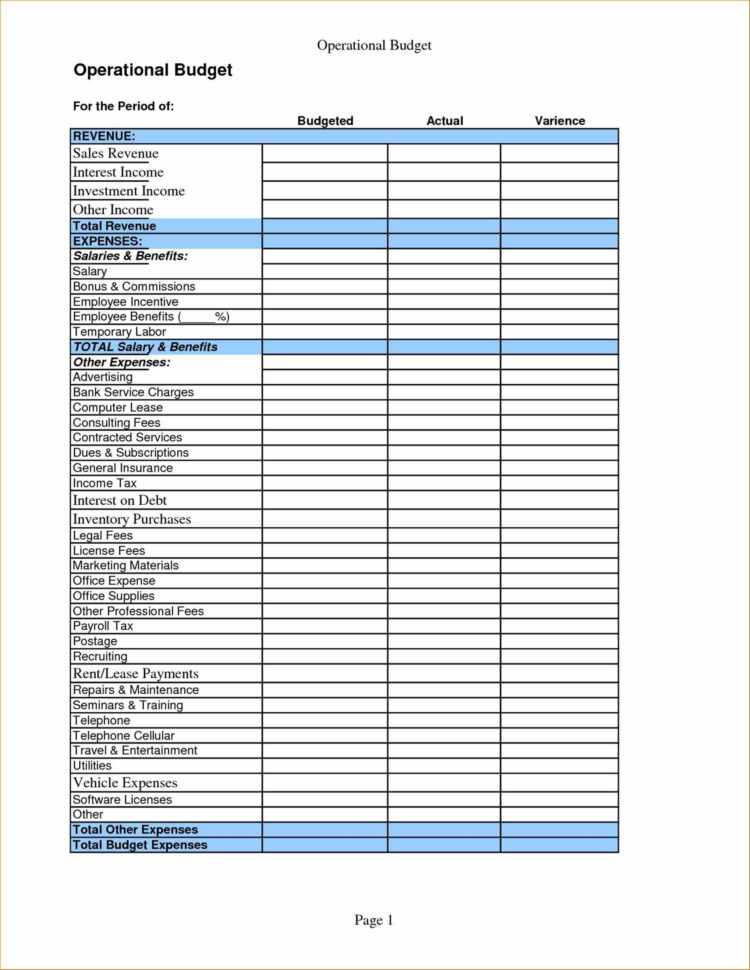

Financial Planning Tip #3: Estimate your Revenue and Expenses.Financial Planning Tip #2: Anticipate Upcoming Internal Expenses.Financial Planning Tip #1: Refresh Upon Changes Within Your Industry.

0 kommentar(er)

0 kommentar(er)